Barclays Raises Rates Amidst Waning Hopes for June Bank Rate Cut

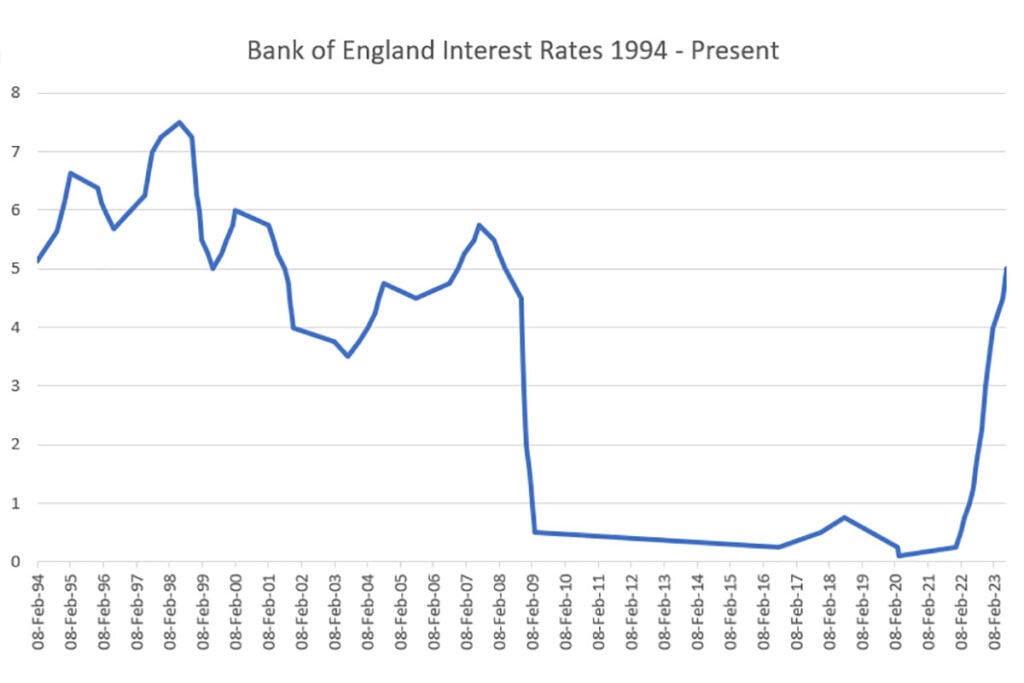

Barclays has increased its variable mortgage rates, signaling a shift in sentiment among UK lenders. This move comes as hopes for a Bank of England base rate cut in June dwindle.

Waning Hopes for June Rate Cut

Previously, markets had anticipated a rate cut in June as the Bank of England sought to mitigate the economic fallout from the COVID-19 pandemic. However, recent data has shown signs of economic recovery, prompting economists to revise their forecasts.

Barclays’ Rate Increase

Barclays has raised its SVR (Standard Variable Rate) by 0.15% to 4.49%. The bank also increased its fixed-rate mortgages by 0.10% to 0.20%. These changes are effective from May 27, 2021.

Impact on Borrowers

For borrowers with variable-rate mortgages, the increase will result in higher monthly repayments. A homeowner with a £100,000 mortgage will see their monthly payments rise by approximately £14.

Implications for Housing Market

The rate increase could potentially cool the UK housing market, as higher borrowing costs may make it more difficult for prospective buyers to afford mortgages. However, the overall impact may be limited given the continued strong demand for property.

Analysis

Analysts believe Barclays’ move is a reflection of the changing economic landscape. As the UK economy recovers, lenders are becoming more confident about the prospects for growth and are therefore raising rates to protect their margins.

Conclusion

Barclays’ rate increase is a reminder that the era of ultra-low interest rates may be coming to an end. Borrowers should be aware that further rate rises are possible in the future and adjust their financial plans accordingly.Barclays has become the latest lender to raise its mortgage rates, as hopes fade for a Bank of England interest rate cut in June. The bank has increased its rates on a range of two-year and five-year fixed-rate mortgages by up to 0.15%. This follows a similar move by Halifax, which increased its rates on a range of two-year and five-year fixed-rate mortgages by up to 0.20% last week. The rate rises come as the Bank of England is expected to keep interest rates on hold at its meeting next week. The central bank had been expected to cut rates in June, but this now looks less likely as the economy shows signs of improvement. The latest GDP figures showed that the UK economy grew by 0.8% in the first quarter of the year, the fastest pace of growth since the third quarter of 2016. This has led some economists to believe that the Bank of England may be less likely to cut rates in the near future. The rate rises are a blow to homeowners who are hoping to take advantage of lower interest rates to remortgage or buy a new home. However, they are unlikely to have a significant impact on the overall housing market, which is still being supported by strong demand from buyers.