Affirm’s BNPL Expansion Coincides with Payday

Affirm, a popular buy now, pay later (BNPL) provider, has recently expanded its offerings to include two new options: Payday and Split Pay. The launch of these options coincides with the timing of payday for many workers, indicating a strategic move by Affirm to tap into the financial needs of consumers during this period.

Payday

Payday is a BNPL option that allows consumers to split their purchases into two equal payments. The first payment is due the day after the purchase, while the second payment is due two weeks later. This option is ideal for consumers who need more time to pay for their purchases without incurring interest or late fees.

Split Pay

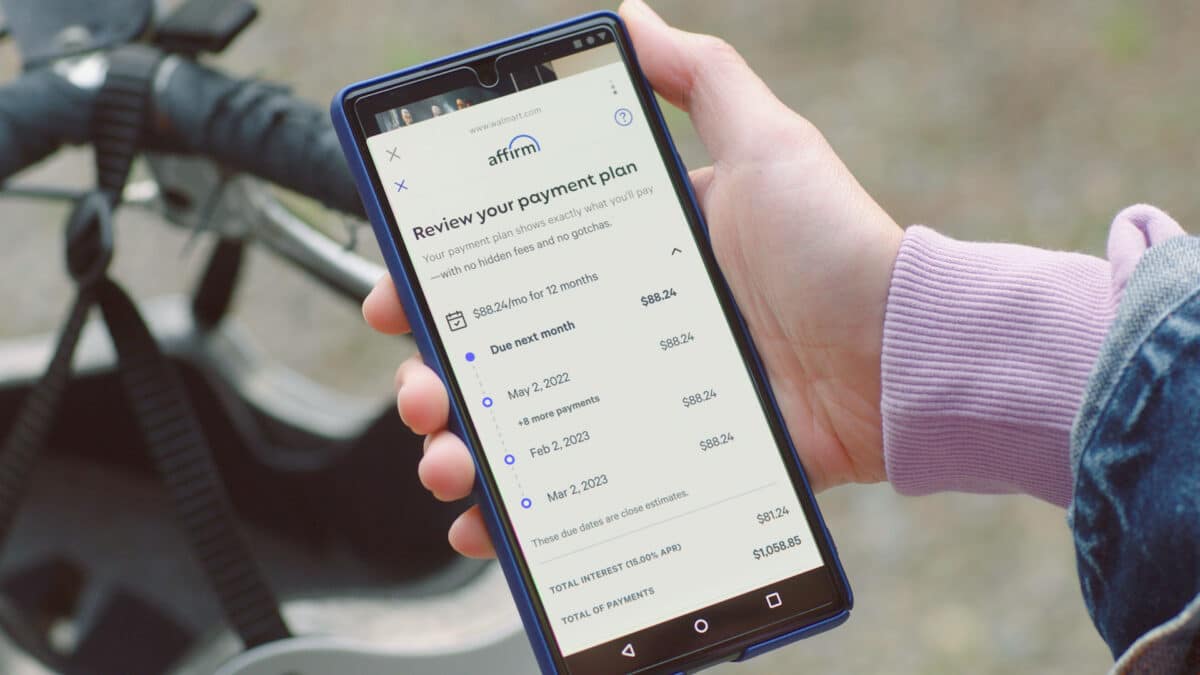

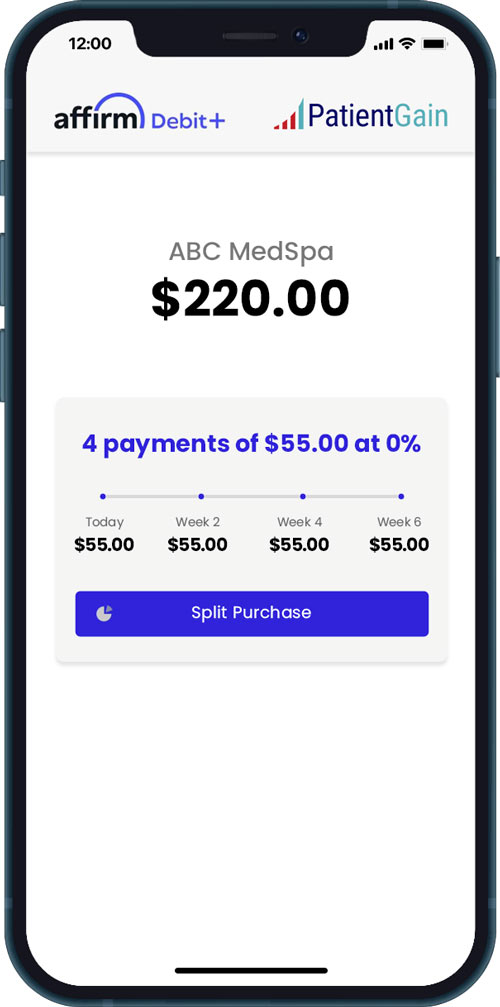

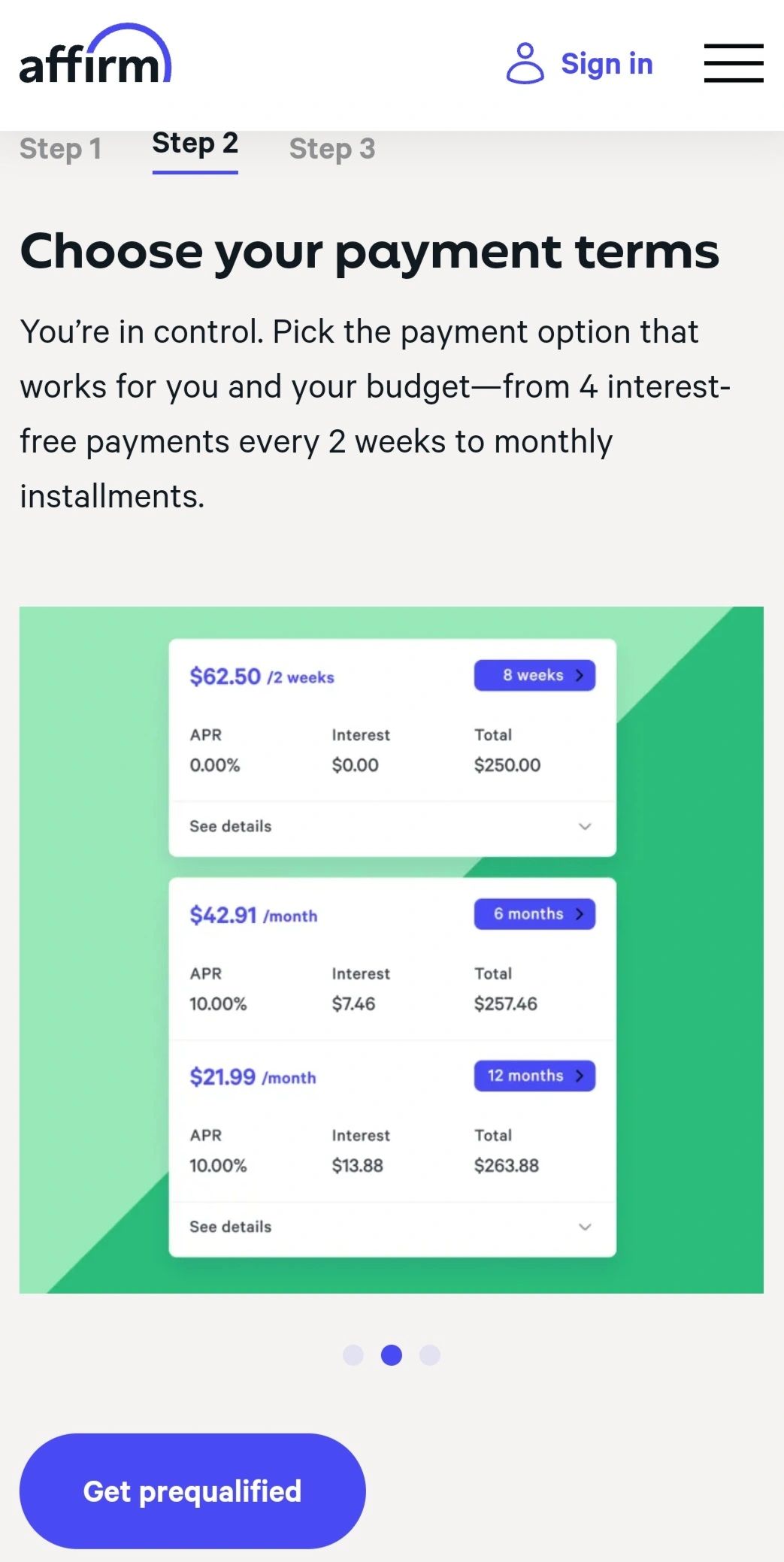

Split Pay is another BNPL option that allows consumers to split their purchases into four equal payments. The first payment is due at the time of purchase, while the remaining payments are due every two weeks. This option provides consumers with even more flexibility to budget for their purchases.

Strategic Timing

The launch of Payday and Split Pay by Affirm is no coincidence. The timing aligns perfectly with the payday for many workers. This strategic move by Affirm allows the company to tap into the financial needs of consumers who may be looking for ways to manage their expenses before their next paycheck. By providing BNPL options that cater to the needs of consumers during this specific period, Affirm can increase its customer base and establish itself as a reliable financial partner for those who need flexibility and affordability.

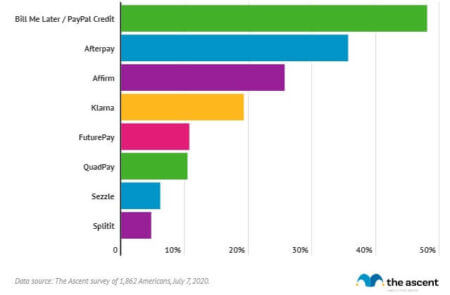

Impact on BNPL Market

The expansion of Affirm’s BNPL offerings is likely to have a significant impact on the BNPL market. Affirm has a large customer base and a strong brand reputation, which will give Payday and Split Pay a significant competitive advantage. Other BNPL providers are expected to follow suit and introduce similar options to stay competitive.

Conclusion

Affirm’s launch of Payday and Split Pay is a strategic move that will likely solidify the company’s position as a leader in the BNPL market. The timing of the launch coincides with payday for many workers, indicating Affirm’s understanding of consumer financial needs. These new options provide consumers with greater flexibility and affordability, which is likely to increase Affirm’s customer base and drive growth in the BNPL industry.Affirm Expands BNPL Options with Pay in 2 and Pay in 30

Affirm Expands BNPL Options with Pay in 2 and Pay in 30

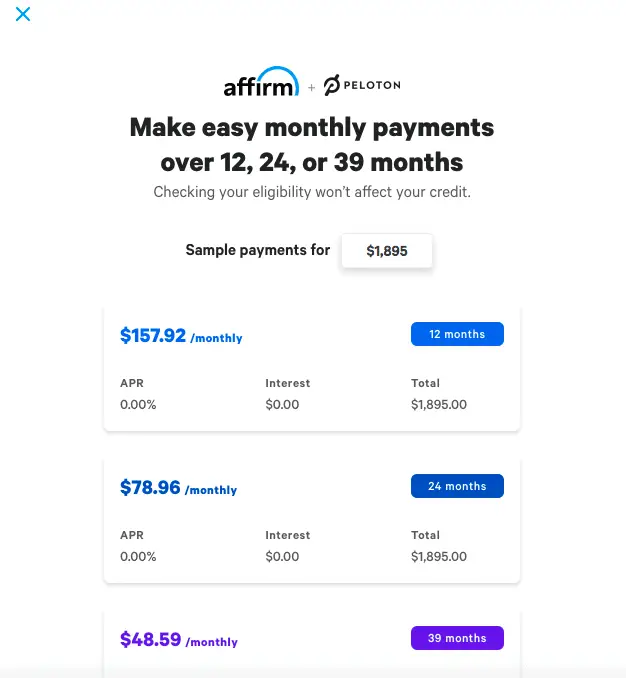

Affirm has introduced new buy now, pay later (BNPL) options to provide customers with greater flexibility in managing their purchases. These options include: *

Pay in 2:

Allows customers to divide a purchase into two interest-free payments. *

Pay in 30:

Enables users to pay for a purchase without interest within 30 days. According to Affirm, these short-term alternatives were developed to address the fact that 80% of U.S. e-commerce transactions are under $150. They are also designed to cater to the approximately 30% of non-farm employees who receive paychecks biweekly or monthly. Affirm believes that offering these choices aligns with their goal of meeting consumer needs. Vishal Kapoor, head of product at Affirm, stated, “By adding options like Pay in 2 and Pay in 30, we can better meet consumers’ individual preferences, allowing them to pay for purchases large or small with more options that best fit their budget.”

Concerns over BNPL as a Credit Card Alternative

Recent concerns have emerged about the future of BNPL after the Consumer Financial Protection Bureau (CFPB) issued an interpretive rule requiring BNPL providers to adhere to the same regulations as credit card companies. This includes providing monthly statements and disclosing interest charges and fees. Affirm’s leadership has expressed their support for this rule, emphasizing their commitment to responsible lending and their belief that consumers should have transparent and flexible payment options.

Market Outlook for BNPL

Despite regulatory changes, the BNPL sector is expected to remain robust. Affirm recently expanded its reach through a partnership with Sensepass, which integrates with over 100 wallets. Affirm’s BNPL products are now accessible at over 292,000 U.S. point-of-sale merchants. Early testing of the Pay in 2 and Pay in 30 options has shown promising results in increasing cart conversions. Affirm plans to roll out these options to its retail partners in the near future.

Affirm Expands BNPL Offerings, Capitalizing on Payday

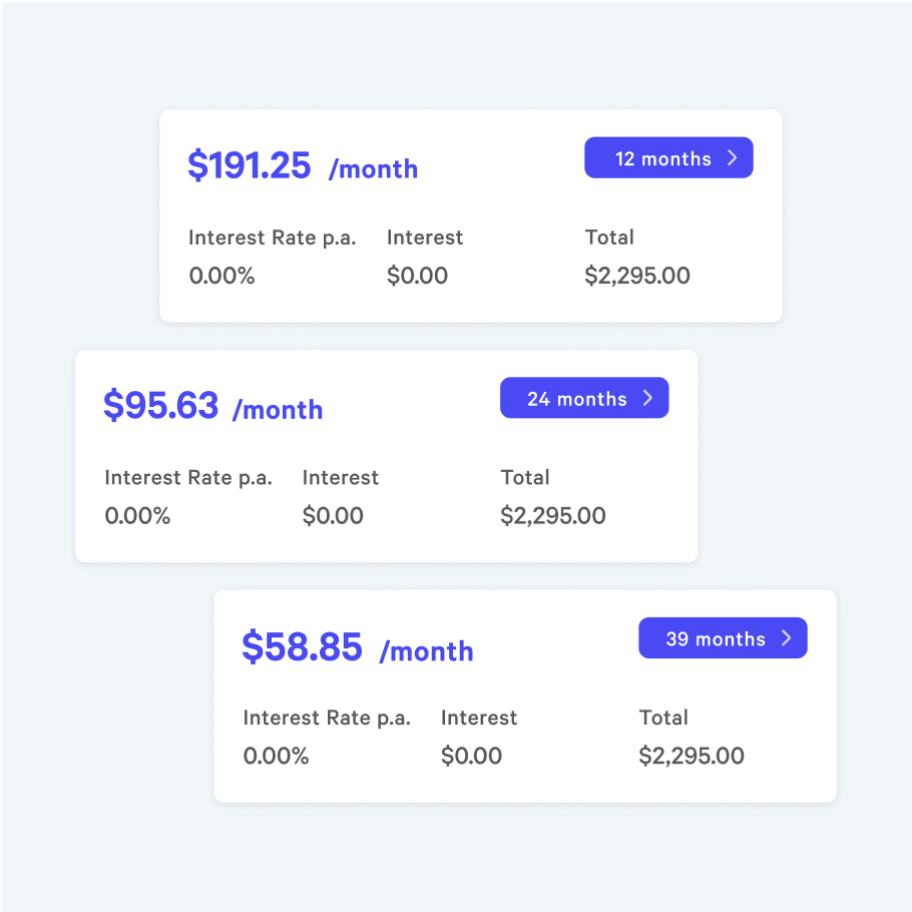

Financial technology company Affirm has recently introduced new “buy now, pay later” (BNPL) options, coinciding with the arrival of Payday for many consumers. The move aims to provide flexibility and affordability during a time of increased financial constraints. Affirm’s BNPL offerings now include a “Pay in 4” option, which allows customers to divide their purchases into four equal, interest-free payments over six weeks. Additionally, the company has expanded its “Pay Monthly” option, offering flexible repayment terms of up to 48 months for larger purchases. These new options align with the timing of Payday, when many consumers receive their wages and are looking for ways to manage their expenses. By offering BNPL options, Affirm aims to help customers spread out their purchases and avoid high-interest credit card debt. “We know that Payday can be a challenging time for many consumers,” said Max Levchin, CEO of Affirm. “Our expanded BNPL offerings provide a responsible and flexible way for people to make purchases without overwhelming their budgets.” The move by Affirm comes amidst a growing trend towards BNPL options in the retail sector. As more consumers seek alternatives to traditional credit cards, BNPL providers have gained popularity. However, concerns have been raised about the potential for consumers to accumulate excessive debt and hidden fees associated with BNPL services. Affirm emphasizes its commitment to responsible lending and transparency. The company’s BNPL offerings are subject to credit checks and other eligibility criteria. Additionally, Affirm provides customers with clear and upfront information about fees and repayment terms. “We believe that BNPL can be a valuable tool for consumers when used responsibly,” said Levchin. “We are focused on providing our customers with flexible and affordable financing options that help them achieve their financial goals.”