European Stocks Commence Day with Tranquility

European equity markets opened with a sense of calm on Monday, reversing the losses witnessed in the previous session. Investors displayed a more relaxed attitude as concerns over global economic growth eased. *

Positive PMI Data:

Encouraging Purchasing Managers’ Index (PMI) data from the Eurozone and Germany boosted market sentiment. The eurozone composite PMI rose to 46.7 in August, marking its highest level since April. *

Easing Inflation Fears:

Recent data indicating a slowdown in inflation across the continent provided some relief to investors. There is growing hope that inflation may have peaked, reducing pressure on central banks to aggressively raise interest rates. *

Energy Prices Stabilize:

The stabilization of oil and gas prices in recent weeks has alleviated concerns about the impact on corporate earnings and consumer spending. *

Caution Remains:

Despite the positive start, analysts caution that geopolitical uncertainties, particularly the ongoing conflict in Ukraine, could continue to weigh on market sentiment. *

Sector Performance:

Technology and industrial stocks led the gains, while consumer staples and utilities underperformed.

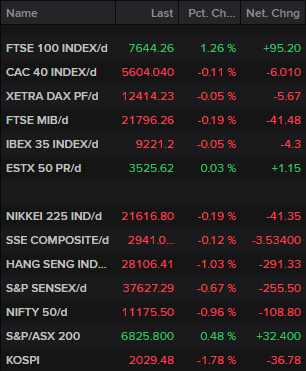

Indices Update:

* FTSE 100 (UK): Up 0.5% * DAX (Germany): Up 0.7% * CAC 40 (France): Up 0.6% * Euro Stoxx 50: Up 0.6%

Outlook:

The market mood for European stocks is likely to remain influenced by developments in the global economy, inflation trends, and geopolitical factors. However, the calmer start to the day suggests that investors are becoming more comfortable with the current market environment.European Stock Markets Update

European Stock Markets Update

European stock markets opened slightly higher on Monday, but the gains were capped by concerns over the impact of the Omicron variant and the upcoming key risk events.

Index Performance:

* Eurostoxx: +0.3% * Germany (DAX): +0.2% * France (CAC 40): +0.3% * Britain (FTSE): +0.3% * Spain (IBEX): -0.1% * Italy (FTSE MIB): +0.2%

Market Sentiment:

The overall market sentiment remains subdued, as investors await tomorrow’s crucial risk events. S&P 500 futures are currently flat.

Notable Movements:

* The CAC 40 opened the week closer to 7,800 but has already regained 1.4% from yesterday’s low. * Spain’s IBEX is the sole loser among the major European indices, declining 0.1%.

Key Risk Events:

* The Federal Reserve’s interest rate decision on Wednesday. * The Bank of England’s policy meeting on Thursday. * The European Central Bank’s policy meeting next week.European stocks traded higher on Tuesday morning, following positive cues from Asia and a slight rebound on Wall Street overnight. The Stoxx 600 index gained 0.3% in early deals, with all sectors and major bourses in positive territory. Travel and leisure stocks led the gains, rising 1.2%. The upbeat mood came after Asian markets closed mostly higher, with Japan’s Nikkei 225 jumping 2.3% and China’s CSI 300 index climbing 1.2%. U.S. stocks also closed with modest gains on Monday, with the S&P 500 index rising 0.3%. Investors appeared to be taking a more optimistic view of the economic outlook, despite ongoing concerns over the war in Ukraine and rising inflation. Some analysts believe that the market may have already priced in much of the negative news and is now looking ahead to a potential recovery later in the year. “The market seems to be stabilizing after the recent sell-off, and investors are starting to look for value in beaten-down stocks,” said Chris Beauchamp, chief market analyst at IG Group. However, some analysts cautioned that the rally could be short-lived, as geopolitical risks and inflation remain major concerns for investors. “We’re still in a very uncertain environment, and there are a lot of risks out there,” said Keith Wade, chief economist at Schroders. “I wouldn’t be surprised if we see some volatility in the coming weeks.” In corporate news, Norwegian Cruise Line Holdings (NCLH) shares jumped 6.5% after the company reported better-than-expected quarterly results and announced a share buyback program. On the downside, shares of HSBC Holdings (HSBA) fell 1.2% after the bank reported a decline in first-quarter profit.