Novita SA: Dividend AnalysisNovita SA: Dividend Analysis Novita SA (WSE: NVT) is scheduled to trade ex-dividend on July 25, 2024. Shareholders who purchase shares on or after this date will not be eligible to receive the dividend, which will be paid on August 7, 2024. Dividend Yield The upcoming dividend is zł9.20 per share, which equates to a trailing yield of 7.4% based on the current share price of zł123.50. Dividend Sustainability However, there are concerns about the sustainability of Novita’s dividend. * Profit Coverage: Novita paid out 123% of its profits in dividends last year, an unsustainably high level. * Cash Flow Coverage: The company also paid out more free cash flow than it generated last year (130%). Earnings and Dividend Growth * Earnings Growth: Novita’s earnings per share have grown at a healthy rate of 12% per year over the past five years. * Dividend Growth: The company has increased its dividend by an average of 11% per year over the past ten years. Risks Despite the dividend growth, potential investors should note the following risks: * High Dividend Payout Ratio: Novita’s high dividend payout ratio raises concerns about the sustainability of the dividend. * Overcommitment: The company’s over-distribution of profits and cash flow may limit its ability to invest in growth and withstand economic downturns. Conclusion While Novita’s earnings and dividend growth are encouraging, the high dividend payout ratio and excessive cash flow distribution raise concerns about the long-term sustainability of its dividend. Potential investors should carefully consider these risks before making investment decisions.

Regular readers know that we love our dividends at Simply Wall St., so it’s exciting to see Novita SA (WSE:NVT) is set to trade ex-dividend in the next four days. Typically, the ex-dividend date is one business day before the record date, the date on which a company determines which shareholders are eligible to receive a dividend. The ex-dividend date is an important date to watch out for, as any purchase of the stock on or after this date could result in a late settlement that will not be reflected on the record date. So, you can buy Novita shares before July 25 to receive the dividend, which the company will pay on August 7.

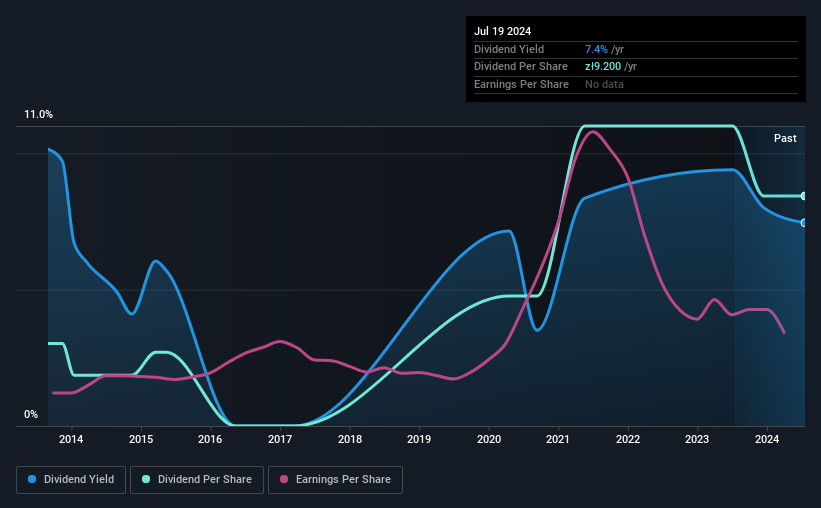

The company’s upcoming dividend is zł9.20 per share, after the last 12 months when the company paid out a total of zł9.20 per share to shareholders. Calculating the last year’s payments shows that Novita has a trailing yield of 7.4% on the current share price of zł123.50. Dividends are an important contributor to investment returns for long-term investors, but only if the dividend continues to be paid. So we need to investigate whether Novita can afford its dividend and whether the dividend can grow.

View our latest analysis for Novita

Dividends are typically paid out of company profits. If a company pays out more in dividends than it earned in profits, the dividend may be unsustainable. Novita paid out an unsustainably high dividend of 123% of its profits to shareholders last year. Without more sustainable payment behaviour, the dividend looks precarious. However, cash flow is typically more important than profits when assessing dividend sustainability, so we should always check that the company generates enough cash to afford its dividend. Novita paid out more free cash flow than it generated last year – 130% to be exact – which we think is worryingly high. We’re interested in finding out why the company paid out more cash than it generated last year, as this can be one of the first signs that a dividend is unsustainable.

Cash is slightly more important than profit from a dividend perspective, but given that Novita’s payments were not well covered by either profit or cash flow, we are concerned about the sustainability of this dividend.

Click here to see how much of Novita’s profits have been paid out over the past 12 months.

Have profits and dividends increased?

Companies with strong growth prospects tend to be the best dividend payers, because it is easier to grow dividends when earnings per share are improving. If the company goes into a recession and the dividend is cut, the value of the company can fall dramatically. That’s why we’re pleased to see Novita’s earnings per share growing by 12% per year over the past five years. It’s great to see earnings per share growing quickly, but we’re concerned that the company paid out 123% of its profits last year. We’re wary of high-growth companies that burn themselves out by over-committing themselves financially, and see this as a yellow flag.

Many investors judge a company’s dividend performance by evaluating how much its dividend payments have changed over time. Over the past 10 years, Novita has increased its dividend by an average of about 11% per year. It’s exciting to see that both earnings and dividend per share have grown rapidly over the past few years.

Last takeaway

Is Novita worth buying for its dividend? Earnings per share have been growing despite the fact that the company pays out a worryingly high percentage of its profits and cash flow. We struggle to see how a company that pays out so much of its profits and cash flow can maintain its dividend in a recession, or reinvest enough in its business to grow earnings without borrowing heavily. In short, Novita has a number of unfortunate characteristics that we believe could lead to suboptimal outcomes for dividend investors.

That said, if you’re looking at this stock without much concern for the dividend, you should still be aware of the risks that Novita carries. For that reason, you should learn more about the 2 warning signs We spotted a few at Novita (including 1 that is worrying).

A common investment mistake is buying the first interesting stock you see. Here you can find a complete list of high yielding dividend stocks.

Valuation is complex, but we make it simple.

Find out if New may be over or undervalued by looking at our comprehensive analysis, which includes the following fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the free analysis

Do you have feedback on this article? Are you concerned about the content? Contact Us directly with us. You can also email editorial-team (at) simplywallst.com.

This article from Simply Wall St is general in nature. We comment solely on historical data and analyst forecasts, using an objective methodology. Our articles are not intended as financial advice. It does not constitute a recommendation to buy or sell any shares and does not take into account your objectives or financial situation. We aim to provide you with a long-term analysis driven by fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in the shares mentioned.

Valuation is complex, but we make it simple.

Find out if New may be over or undervalued by looking at our comprehensive analysis, which includes the following fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the free analysis

Do you have feedback on this article? Are you concerned about the content? Please contact us directly. You can also send an email to [email protected]